5 Cheapest Web Hosting for WordPress in 2026

27 July 2023

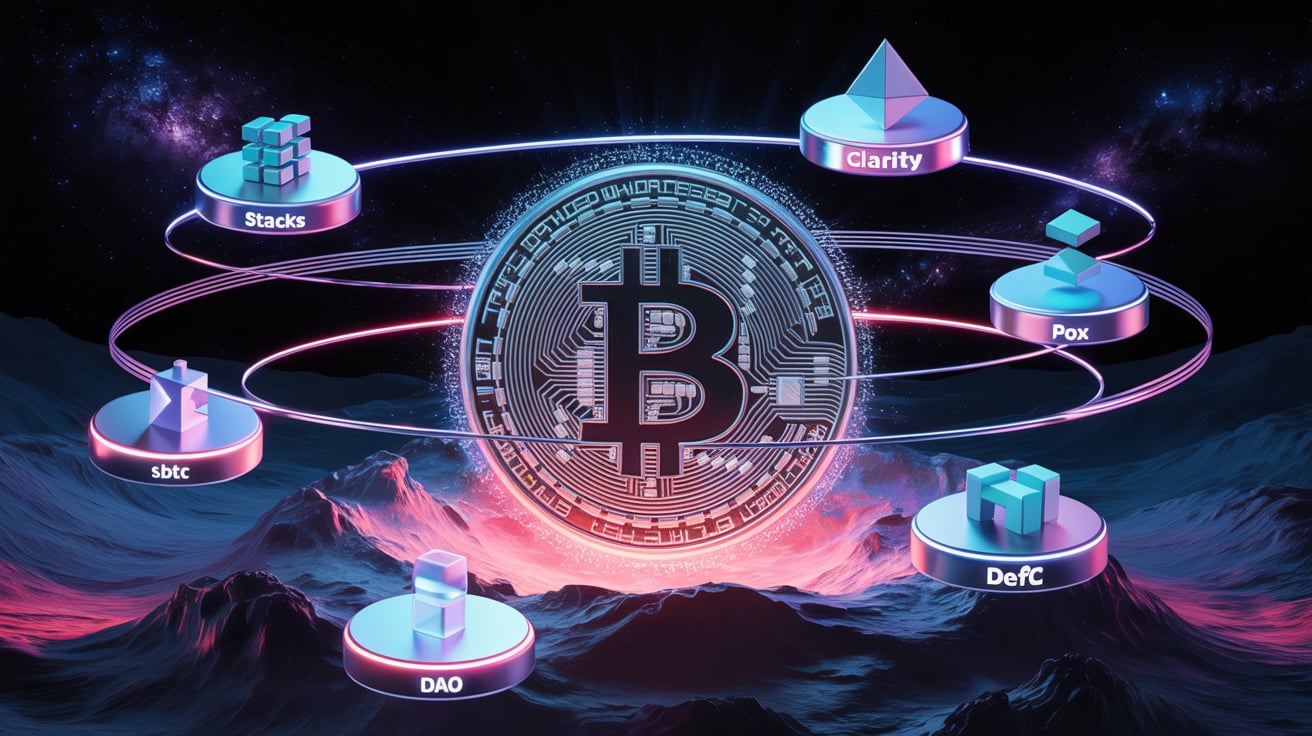

Did you know that you can make passive income by earning new STX tokens on the Bitcoin ecosystem? Stacks allows developers to build smart contracts with a unique consensus mechanism called Proof of Transfer (PoX).

If you want to join the list of Stacks miners to earn Bitcoin rewards, this article will show you everything you need to know about Stacks platform. Touching on areas like the new Stacks token, importance of Stacks on the Bitcoin blockchain, and how STX holders can earn with the network.

Stacks is a decentralized Layer-2 network that creates decentralized applications and smart contracts on Bitcoin. Stacks leverages the security and smart contract functionality of Bitcoin to create a friendly environment zone for developers to create dApps built on Stacks.

Stacks was co-founded by Muneeb Ali and Ryan Shea, the platform was initially called "Blockstack" in 2013 and had upgrades to the Stacks protocol in 2021 during the launch of Stacks 2.0.

Stacks enables the creation of dApps through a Proof of Transfer (PoX) mechanism, allowing users in the crypto market to lock BTC and earn a minimum amount of STX while supporting the network. In a nutshell, Stacks is a cryptocurrency network that gains security from the Bitcoin network.

Learn how the Stacks base layer works in the table below:

| Component | Function |

| Stacks Network | Execute smart contracts on Stacks |

| Clarity Language | The language used on Stacks |

| PoX Mechanism | Chains blocks to Bitcoin, making a 2-chain structure |

| Stacking | Locking up your STX tokens to earn BTC rewards |

The Stacks foundation is growing rapidly in different areas like NFTs, DeFi, wallets, and DAOs. Here are major projects carried out by the Stacks team:

1. ALEX (DeFi Platform): This is a DeFi platform that uses Stacks for borrowing, lending, and yield farming, while remaining secure on the Bitcoin network.

2. Gamma.io (NFT Marketplace): A reputable NFT marketplace for people to trade and mint NFTs that remains on Bitcoin

3. Hiro Wallet: Stacks introduces Hiro Wallet for executing Clarity contracts, managing and storing STX tokens.

4. Zest Protocol: This platform was developed on Bitcoin, and it is an institutional DeFi platform that allows holders of Bitcoin to earn yield via lending pools.

5. StacksBridge: Acts as a cross-chain bridge connecting Stacks with other networks like Solana and Ethereum.

Stacks uses Bitcoin security and decentralization, allowing users to earn enough STX while maintaining the network security. There are two ways to make passive income with Stacks:

Download and install the Xverse wallet on your phone or as an extension on your Chrome browser.

Buy or deposit STX into your wallet.

Stack your STX tokens by selecting a stacking pool.

Confirm the transaction

Earn BTC rewards every two weeks.

Use the Hiro Wallet

Make sure that you meet the threshold for minimum stacking

Link your Hiro Wallet to a stacking dashboard

Lock your Stacks token and add your BTC wallet address

Earn rewards after each cycle which is 2 weeks.

STX is the native token of the Stacks ecosytem. You can purchase Stacks through: Y

Self-stacking demands a minimum amount of ~100,000 STX. Note that this amount can vary for each cycle. Using this method gives complete control of earnings and you will need a Bitcoin wallet to get your rewards after 2weeks.

This method is suitable for people with less tokens. You can use options like OKCoin Pool, Stacking DAO, and Xverse Wallet. Note that these Stacking pools demand 1 STX fir participation.

1. Stacks is a Bitcoin secured network, meaning that every transaction is stored on the blockchain

2. Stacks also can be used to support DAOs and NFTs to boost decentralized ownership

3. The Clarity language ensures that Stacks contracts are predictable and readable.

4. STX also can be used for stacking, allowing users to earn rewards in BTC.

Stacks adds extra layer to the Bitcoin network. The importance of Stacks can be seen in areas like NFT minting, smart contract execution, powering of DeFi tools, and network fees payment. Furthermore, the Nakamoto upgrade in 2024 has enabled Bitcoin-native assets and fast finality. This upgrade makes Stacks more seamless for blockchain developers and users who want to explore the Stacks ecosystem.

STX is the token of the Stacks ecosystem, and it is used for powering smart contracts, paying transaction fees, and maintaining the network operation. Below is everything you need to know:

| Metric | Value |

| Total Supply | 1.818 Billion |

| Circulating Supply | ~1.4 billion STX |

| Inflation Rate | Depends on unlocking period. |

Stacks have a maximum supply that is fixed, and tokens are released periodically based on a transparent schedule, making it an attractive investment for long-term holders because there is no infinite inflation.

STX can be used for various purposes which was described earlier, and you can purchase STX through the following steps:

STX is listed on popular cryptocurrency exchanges like Binance, KuCoin, Coinbase, and OKX. You can select a platform that has user experience and good liquidity to purchase the native cryptocurrency. Make sure the exchange you choose supports your payment channel and region.

Register a new account using a phone number or email and complete your verification through KYC. You can set up 2FA after verification for extra security

Fund your account with fiat currencies like USD or you can use stablecoins like USDT and USDC. Other crypto like ETH and BTC can also be used for funding. Select the right payment methods to use.

After funding your account, you can buy the STX tokens by using the STX trading pair which is STX/USDT or STX/USD. You can use a limit order to set your price or market order for instant purchase.

STX is used for long-term storage or trading. You can use a self-custodial wallet like Hiro Wallet to store your tokens for long-term or keep it on a centralized exchange if you plan on doing daily transactions with other cryptocurrencies.

| Use Case | Description | Example Platform |

|---|---|---|

| Smart Contracts | Bitcoin-secured, transparent contracts | Clarity, Hiro |

| DeFi | Lending, staking, DEXs on Bitcoin | ALEX, Zest Protocol |

| NFTs | Mint/trade Bitcoin-secured NFTs | Gamma.io |

| dApps | Web3 apps built with Bitcoin’s trust layer | Sigle, Riot.app |

| Stacking | Earn BTC by locking STX | Xverse, Hiro |

| Identity & Domains | Own domains & control identity | BNS, Stacks ID |

| Bitcoin L2 Tools | Launch scalable Bitcoin-native apps | Hiro, Trust Machines |

Stacks connects with the Bitcoin network and was made to solve the following problems:

Lack of Smart Contracts: Stacks takes the smart contract deficiency by introducing safe contracts that are Turing-incomplete via Clarity.

Lack of Native dApps: Blockchain developers can build dApps that run on the Bitcoin network.

Underutilized BTC Capital: Unlocks DeFi and yield farming opportunities for BTC holders.

Want to Learn More? Watch these videos to learn more on how smart contracts and decentralized applications are built on the Stacks network

1. Stacks 2.0 Explained - Whiteboard Crypto

2. How STX Uses Bitcoin to Power dApps – Finematics

3. What is Stacks (STX)? – Coin Bureau

Stacks merges Bitcoin’s unmatched decentralization and security with next-gen smart contracts and dApps, powered by PoX consensus and Clarity. The ecosystem’s maturity—backed by real tools, projects, community, and the Nakamoto upgrade—positions STX as the leading Bitcoin-native development layer. Whether you're building, investing, or learning, Stacks blockchain opens the door to a programmable Bitcoin future.

Bitcoin is Layer‑1 asset and settlement layer. Stacks is a Layer‑2 chain built on top that enables smart contracts and dApps using Bitcoin’s security.

PoX requires miners to transfer BTC to deploy blocks. They earn STX while securing both chains, leveraging Bitcoin’s network instead of burning tokens

A predictable, decidable smart contract language designed to eliminate unintended behaviors and increase security

Through STX stacking, users lock tokens to secure the network and earn BTC rewards through a unique incentive tied back to Bitcoin