5 Cheapest Web Hosting for WordPress in 2026

27 July 2023

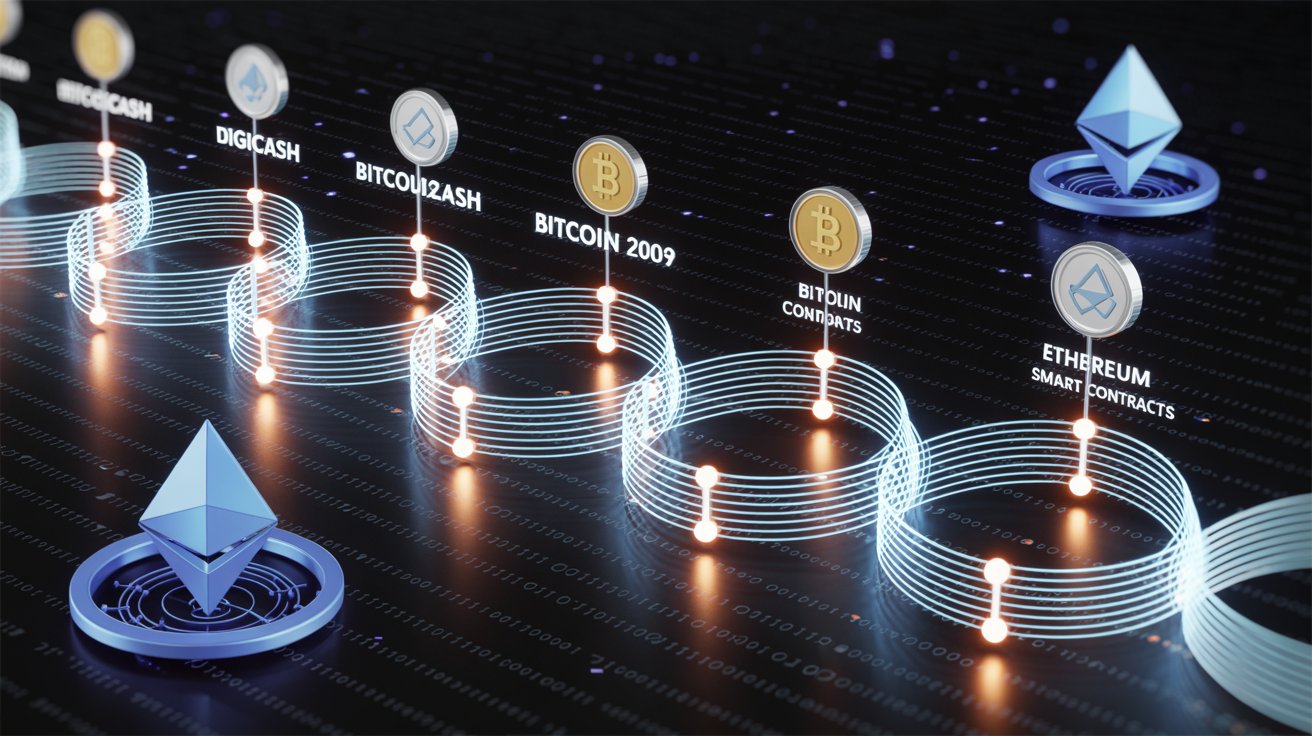

Have you imagined how the Bitcoin blockchain began or why the adoption of cryptocurrencies has grown to become a global trend? Ever since Satoshi Nakamoto mined the first decentralized digital currency called Bitcoin in 2009, investing in cryptocurrency has skyrocketed.

If you are wondering the history of the cryptocurrency network, this article will discuss everything you need to know about it. We will talk on the future on virtual currencies, how to conduct a cryptocurrency transaction, and popular cryptocurrencies like Bitcoin and Ethereum.

As an investor looking to leverage blockchain technology and cryptocurrencies, understanding these major points can better help you make educated decisions and appreciate the market capitalization of cryptocurrencies.

The concept of digital money as an alternative to fiat currencies initially began in 1980s and 1990s, where developers and cryptographers experimented with electronic cash networks like:

David Chaum’s DigiCash (1989): This is one of the earliest digital currencies that used cryptographic protocols for maintaining privacy.

Wei Dai’s b-money (1998): He introduced a new form of currency that is anonymous and distributed, which went on to inspire the biggest cryptocurrency.

Nick Szabo’s Bit Gold (1998): A precursor to Bitcoin that suggested a decentralized mechanism called Proof-of-Work (PoW).

These early attempts were not successful because of lack of mass adoption, centralization, and technological limitations. However, they laid the foundation for Bitcoin and other cryptocurrencies.

Satoshi Nakamoto in October 2008 released the Bitcoin whitepaper, called "Bitcoin: A Peer-to-Peer Electronic Cash System." This whitepaper discussed a decentralized network where people can make transfers without using an intermediary or bank

Furthermore, Nakamoto mined the genesis block of the Bitcoin network in January 3, 2009, adding the message “The Times 03/Jan/2009 Chancellor on brink of second bailout for banks.” This marked the new cryptocurrency era and alternative cryptocurrencies.

Bitcoin Pizza Day (May 22, 2010): Laszlo Hanyecz, a programmer paid 10,000 BTC for 2 pizzas, signaling the first real-world cryptocurrency purchase.

2011: Other cryptocurrency assets like Namecoin and Litecoin came into existence, providing different applications and faster transactions in the cryptocurrency ecosystem. Bitcoin was most used as a cryptocurrency investment by tech-savvy users on dark web and forums.

2013: The price of BTC passed $1,000 for the first time, capturing widespread attention all over the cryptocurrency community.

2014: Mt. Gox was the biggest cryptocurrency exchange, and it went bankrupt after losing 850,000 BTC. This led to security concerns and people asking if Bitcoin transactions were safe.

2015: Ethereum, the second largest cryptocurrency initiated smart contracts, which were code that can execute agreements automatically. This led to modern cryptocurrency areas like NFTs and Decentralized Finance (DeFi).

2017: Crypto went mainstream. Bitcoin hit nearly $20,000 by December. The ICO (Initial Coin Offering) boom saw hundreds of new tokens emerge, many without substance.

The market bounced back in 2018 with BTC selling for $3,000. However, the cryptocurrency industry exploded when governments recognized and regulated cryptocurrencies. Also, more blockchain developers and institutions joined the space, and new blockchains like Cardano and Polkadot gained momentum.

2021: The Bitcoin exchange crossed $60,000, with popular cryptocurrency like ETH soaring, and NFTs gaining widespread adoption.

Institutional interest: large companies like Tesla, central banks, and Square began buying and holding crypto

DeFi platforms, the concept of Web3 and DAOs began, moving ownership from central bodies to communities.

Governments started forming Central Bank Digital Currencies (CBDC), while El Salvador became the first country to accept Bitcoin as legal tender.

Today, the widespread adoption of cryptocurrencies may be seen by many as a global revolution, touching areas like supply chains, gaming, art, and finance.

The first step for buying cryptocurrency funds is choosing an exchange you trust. Since the launch of Bitcoin in 2009, exchanges like Coinbase, Binance, Kraken, Bybit, and KuCoin are where people buy and sell new cryptocurrencies. Some countries have declared all cryptocurrency transactions illegal, so ensure that it is legal in your country before you buy or sell cryptocurrency.

You will need a cryptocurrency wallet to store your assets after buying. Register a new account on the exchange by creating a strong password and using an email. To boost security, you will be asked to perform KYC by uploading an ID and taking a selfie.

Fund your account on the crypto exchange by using bank transfer, debit/credit card, P2P transaction, and other supported payment methods that is convenient for you. Always check the transaction fees and minimum limits.

Cryptocurrencies are digital currencies that do not need middlemen, you will need to choose the crypto you want to buy. You can go for well-known cryptocurrency like Bitcoin or ETH and SOL.

You will need to make your first purchase if you want to take part in cryptocurrency trading or other transactions. Go to the Buy/Sell dashboard, choose the coin you want to buy, input the amount you want, and confirm the transaction. You will be notified once transaction is successful and the coin will be deposited in your wallet.

In the cryptocurrency space, wallets are important for storing tokens. You can use the exchange wallet or create a personal wallet. For instance, wallets like MetaMask, Trust Wallets, and Trezor can be used to store your coin.

More businesses, central institutions, and governments have now accepted cryptocurrency as a form of exchange, leading to widespread adoption. For example, Central Bank Digital Currencies are globally combining traditional monetary systems with native cryptocurrency like Bitcoin. governments, and financial institutions are integrating crypto.

The first cryptocurrency was Bitcoin, and governments are working tirelessly to regulate the growing crypto market. This is to make cryptocurrency safe, prevent cryptocurrency heist, and protect investors.

Areas like DeFi will keep growing, providing better options for people to stake, lend, and perform yield farming instead of using banks. Also, Web3 platforms will boost complete ownership while offering cryptocurrency as a reward.

NFTs will go beyond art, venturing into areas like real estate, gaming, and intellectual property related to cryptocurrency. Ownership, authenticity, and royalties can be transformed via tokenized assets. expand beyond art into sectors like gaming, real estate, and intellectual property.

With increasing concerns about the environment, more eco-friendly mechanism like Proof-of-Stake (PoS) will be adopted by blockchains to save energy. The transition of Ethereum to PoS is a major example for lower-energy networks.

Advances in zero-knowledge proofs, privacy coins, and hardware wallets will enhance user security. Self-custody and privacy tools will become increasingly important as users seek more control.

Relevant YouTube Videos to understand the history of cryptocurrencies and blockchain technology:

From a humble digital idea in the mind of cypherpunks to a trillion-dollar financial ecosystem, the history of cryptocurrency is a story of innovation, disruption, and decentralization. This article walked you through the most critical milestones—from Bitcoin's mysterious birth to the DeFi boom and beyond—helping you understand how cryptocurrency became a powerful force in the modern economy.

You can also read on the importance of using cold storage to protect your digital assets from hacks.

Answer: Cryptocurrency was first conceptualized by Satoshi Nakamoto, who released the Bitcoin whitepaper in October 2008. Bitcoin, the first decentralized cryptocurrency, launched in January 2009.

Answer: Before Bitcoin, several digital currency projects existed, including David Chaum’s DigiCash (1989), Wei Dai’s b-money (1998), and Nick Szabo’s Bit Gold (1998). These projects influenced the creation of Bitcoin but lacked full decentralization.

Answer: In 2010, the first real-world transaction using Bitcoin occurred when a programmer bought two pizzas for 10,000 BTC. It marked Bitcoin’s first use as a medium of exchange and is now celebrated as “Bitcoin Pizza Day.”

Answer: Ethereum, launched in 2015, introduced smart contracts, enabling developers to build decentralized applications (dApps) on its blockchain. It expanded crypto’s use beyond payments into finance, gaming, identity, and more.

Answer: Key milestones include Bitcoin's launch in 2009, Bitcoin reaching $1,000 in 2013, the Ethereum launch in 2015, the 2017 ICO boom, and institutional adoption and NFT growth in 2021.